Put option profit calculator

After paying the 200 option premium this put option would earn 800. Writing or selling a put option - or a naked put - has a limited but immediate return but exposes the trader to a large amount of downside risk.

Arbitrage Calculator Excel Template Excel Templates Excel Arbitrage Trading

We will keep things where they are for now and explain the profit table which is the heart of OptionStrat.

. Double Calendar Spreads Selling Put Options Getting Paid To Wait And Buy Stocks For Less OptionNet Explorer Review Market Chameleon. Expiry 31st December 2020. Put-call ratio PCR is an indicator commonly used to determine the mood of the options market.

Where cells G4 G5 G6 are strike price initial. With a put option youre essentially managing the risk in your portfolio. In this case that is the 30 strike GME call for February 5th 2021.

Besides underlying price the payoff depends on the options strike price 40 in this particular example and the initial price at which you have. Use the Profit Loss Calculator to establish break-even points evaluate how your. If out-of-the-money options are cheap theyre usually cheap for a reason.

Naked Put bullish Calculator shows projected profit and loss over time. A long put spread or bull put spread is an alternative to buying a long put where you also sell a put at a strike price below the purchased put strike price. Its eroding the value of the option you bought bad and the option you sold good.

The reason for cancelling the contract is simple. This Bank NIFTY option strategy applies only to intraday trading. So in the above call option example.

The Best Weekly Option Strategies Call Option Profit Calculator Iron Condor Calculator Nifty Option Trading Strategies Ultimate Guide To Diagonal Put Spreads What Is IV Crush. Volatility Risk Premium VRP is a known premium that is priced into options to compensate the option seller for the asymmetric risk profile that they take on. Strike price Rs 2000.

Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze the Option Greeks. In general the more puts that exist for a stock ie. Being a contrarian indicator the ratio looks at options buildup helps traders understand whether a recent fall or rise in the market is excessive and if the time has come to take a contrarian call.

Lot Size 505 shares. Those with a high call option volume is a bearish signal for that stock. Put Option Risks.

If the price drops to 90 per share you can exercise this option. Check your strategy with Ally Invest tools. Firstly chart a 5-minute Candle Chart in your charting software.

If you expect the price of Reliance Industries to increase to Rs 2000. By purchasing a put option an investor is hedging that the price of the stock will decrease and is hoping to profit from that by purchasing the put option. It shows a long put option positions profit or loss at expiration Y-axis as a function of underlying price X-axis.

This assymetric profile means that the sellers stand to profit a small fixed amount on their trade but stand to lose a considerable sometimes infinite amount. Strike price minus underlying price if the option expires in the money zero if it doesnt Lets create a put option payoff calculator in the same sheet in column G. So lets say you have 100 shares of Stock ABC currently worth 100 and you think the price will fall.

In other words a put options value is the greater of. Why will you buy Reliance shares at Rs 2000 from the seller if you can buy it. Profit strike price stock price - option cost time value _____ 100 number of contracts Our put calculator above will estimate the value of a long put at any stock price before or at expiry.

Use the Probability Calculator to help you form an opinion on your options chances of. You may purchase a put option with the right to sell at 100 a share. The put option profit or loss formula in cell G8 is.

The ratio is calculated either on the basis of. First he or she would purchase the shares for 90 each. Pick the point at which you will commence your strategy.

Option premium Rs 5715. Of course the share prices might not. If the price of the optioned shares in the earlier example fell to 90 the buyer of an uncovered put option could still require the writer to purchase 100 shares for 100 each.

Using the profit calculator table and chart. When to buy the call option. OptionStrat defaults to a call near the current price of the stock and to a strike about three weeks out.

It is suited to a neutral to bullish market. What happens when options expire to ensure you capture the maximum profit.

Pivot Point Aka Trader S Action Zone Taz Support S1 S2 S3 And Resistance R1 R2 R3 Levels Of Nifty Index Trade Put Option Option Trading Investing

Options Trading Strategies For Consistent Monthly Income

Pin Page

Options Trading Strategies For Consistent Monthly Income Option Trading Options Trading Strategies Trading Strategies

Payout And Profit To Call Option At Expiration Call Option Business Tips Option Trading

Digital Options Synonyms Binary Options All Or Nothing Options Cash Or Nothing Options Asset Or Nothing Options Pays A Set Payoff Options Market Options

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Strategies

Expected Payoff Diagram For Options Trading Quantlabs Net Option Trading Payoff Diagram

Options Premium Calculator Using Black Scholes Model Excel Sheet Premium Calculator Implied Volatility Workbook

Pin On Islamic Quotes

Loading Trading Charts Stock Options Trading Option Trading

Pin On From My Iphone

A Profitable Intraday Trading System Excel Sheet Intraday Trading Interactive Brokers Excel

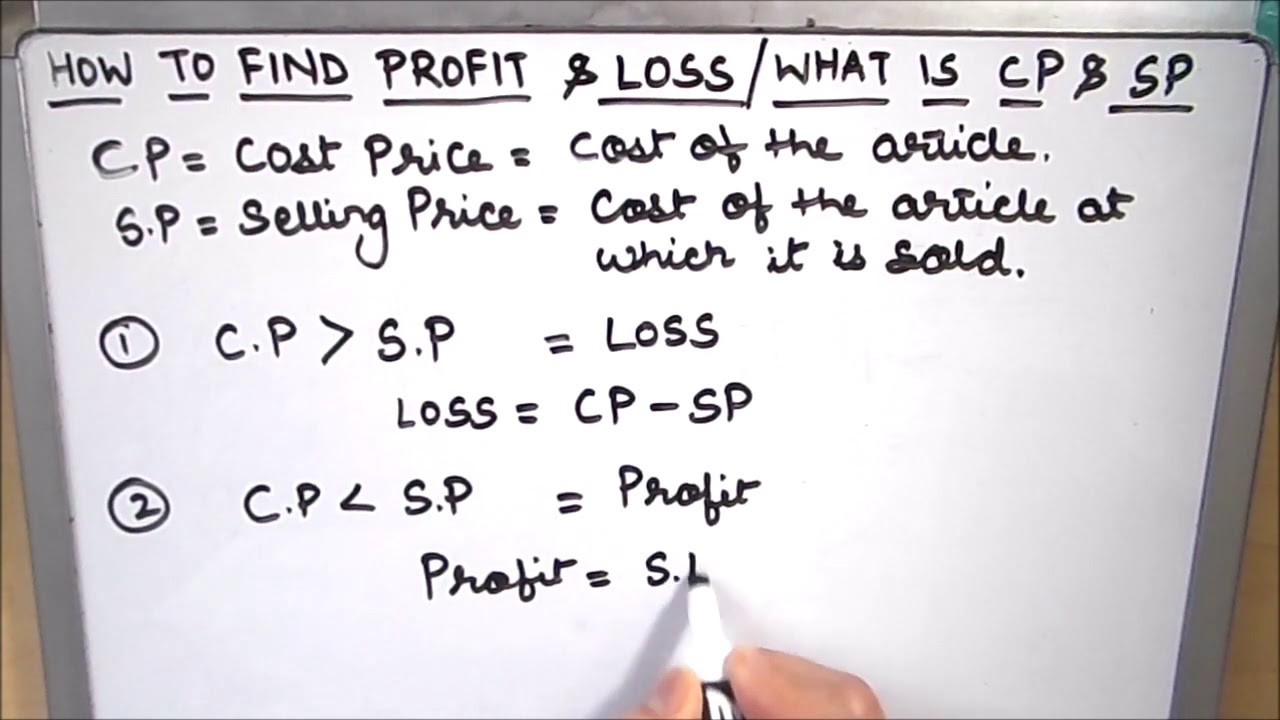

How To Find Profit And Loss Calculate Profit And Loss Using Formula Youtube Profit And Loss Statement Profit Math Videos

What Is Beta Trading Charts Finance Investing Option Trading

What Is Option

Cash Flow Budget Spreadsheet Moneyspot Org Budgeting Worksheets Budgeting Budget Spreadsheet